A detailed explanation of why manufacturing is slowing across major economies like China, Japan, Europe, and the U.S.,

🌍 A Global Slowdown That Everyone Can Feel

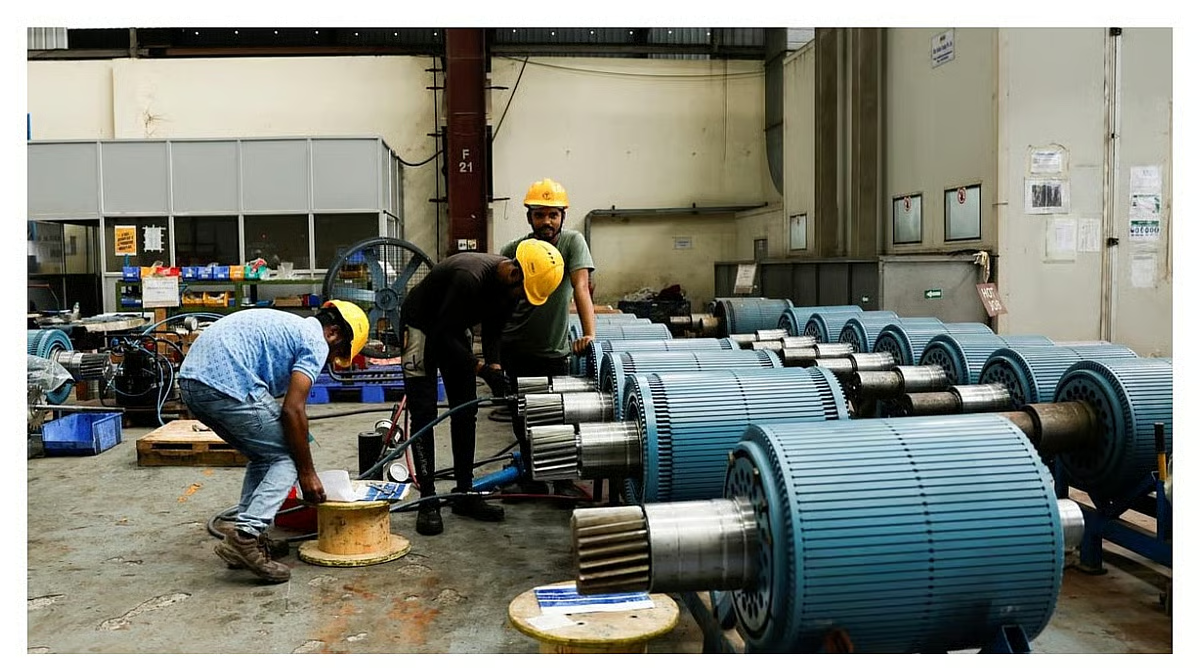

Across the world, factories that once buzzed with energy are now quieter.

Machines run for fewer hours, workers take shorter shifts, and managers look at order sheets with growing concern. The slowdown in manufacturing is not limited to one region — it is stretching from China’s industrial belts to Japan’s tech corridors, and from Europe’s automotive hubs to America’s manufacturing towns.

This slowdown feels like a heavy fog covering the global economy — difficult to escape, and even harder to ignore.

And in the middle of this uncertainty, people still hold onto hope, the same way financial markets glow with resilience during tough times, as shown beautifully in this internal post.

🧩 Why Are Factories Producing Less? Understanding the Real Causes

1. Consumers Are Spending Less

People around the world are tightening their wallets.

Families are thinking twice before purchasing new appliances. Companies are delaying big investments. Even holiday shopping is more cautious than usual.

Less spending means fewer orders, and fewer orders mean factories simply don’t have enough to produce.

2. Trade Conflicts and Shifting Rules

The global trade environment feels like it’s changing every few months.

Tariffs rise, new regulations appear, and countries rethink old partnerships.

These sudden changes force manufacturers to constantly adjust their plans.

Supply chain uncertainty has become a daily struggle, similar to how digital industries face unpredictability as explored in this article on media vs. Big Tech.

3. Rising Costs — From Energy to Transportation

Factories rely heavily on stable energy prices.

But today, oil, electricity, shipping, and raw materials all cost more than they did a few years ago.

For a manufacturer, even a small rise in cost can turn profits into losses.

This has pushed many companies to cut production to survive.

4. The Great Supply Chain Shift Away From China

Many European and American firms are relocating some of their manufacturing away from China due to export controls, political tension, and the need to diversify risk.

This shift creates disruptions — factories move, jobs relocate, and countries enter a new phase of competition.

Even international business reports, including those highlighted by www.america112.com, show how companies everywhere are rewriting their global strategies.

🌐 Which Regions Are Facing the Most Pressure?

🇨🇳 China: The World’s Factory Slows Down

China’s manufacturing has been shrinking as demand weakens both domestically and globally.

Electronics, machinery, and export-based factories are especially struggling.

🇯🇵 Japan: Tech and Auto Industries Under Strain

Japan’s factories are producing less due to lower global orders and competition from other Asian economies.

The automobile sector, once Japan’s strongest pillar, is facing a significant downturn.

🇪🇺 Europe: High Costs, Slow Recovery

European industries are feeling the heat from high energy prices and slow economic recovery.

Germany, the continent’s manufacturing giant, is facing one of its slowest production phases in years.

🇺🇸 United States: Mixed Signals

Some American industries show resilience, but overall U.S. manufacturing remains fragile.

Demand is inconsistent, and businesses are scaling back production schedules.

🔧 How the Slowdown Affects Everyday People

Economic problems can often feel distant, but manufacturing touches daily life in ways we don’t immediately notice.

- Fewer job opportunities in industrial towns

- Lower job security for workers who depend on factory shifts

- Higher prices for everyday items due to rising production costs

- Slower delivery times for electronics, cars, and household items

- Reduced growth for small businesses connected to the supply chain

Behind every falling production index is a human story — a worker hoping for overtime, a family balancing expenses, a small manufacturer praying for new orders.

📉 The Ripple Effect on Global Markets

The manufacturing slowdown doesn’t stay within factory walls. It spills over into:

- global stock markets

- international trade deals

- commodity prices

- shipping and logistics

- consumer confidence

When factories slow down, the world slows down with them.

This ripple effect ties closely to financial trends and market movement, topics explored thoughtfully in this internal article on gold’s recent rise.

🌱 Is There Hope for Recovery? Absolutely.

The slowdown is serious — but not permanent.

History shows that manufacturing cycles rise and fall.

A slowdown today often leads to innovation tomorrow.

As governments revisit trade agreements and businesses adopt smarter technologies, production may gradually pick up again.

Many global analysts, including those featured on www.america112.com, believe that the world is entering a transition phase — a difficult one, but also one full of opportunity.

The world has pulled through worse cycles, and it will pull through this too.

🤍 A Human Ending to a Global Story

It’s important to remember this:

Behind every manufacturing report lies a human face.

A worker hoping for more hours.

A small business owner waiting for better days.

A family balancing dreams and budgets.

The slowdown is real — but so is human resilience.

As economies adjust, industries recover, and people adapt, the world will find its rhythm again.

Just as it always has.