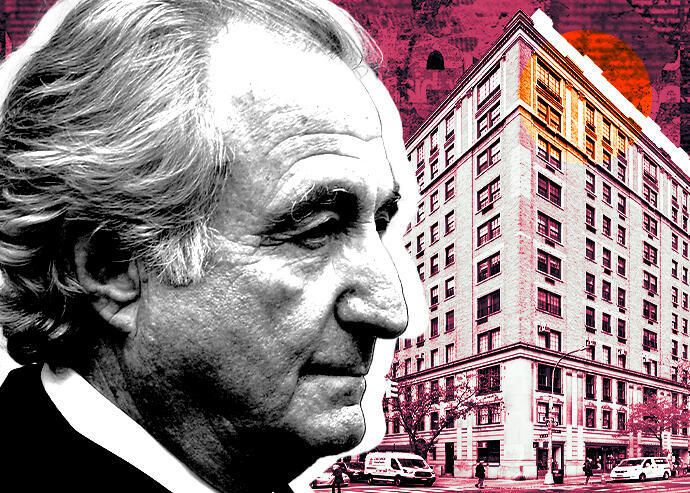

Few names in finance evoke as much infamy as Bernie Madoff. Once a Wall Street titan, Madoff orchestrated the largest Ponzi scheme ever, swindling billions from unsuspecting investors—ordinary people, celebrities, charities, and big financial firms alike. His story isn’t just about financial crime; it’s a chilling lesson in trust, greed, and the devastating fallout when deception goes unchecked.

Who Was Bernie Madoff?

Born in Queens, New York, in 1938, Bernard Lawrence Madoff started his career in finance with ambition and a knack for numbers. In 1960, he founded Bernard L. Madoff Investment Securities LLC, eventually rising to become a respected figure in the industry—even serving as chairman of NASDAQ. For decades, he cultivated an image of success, drawing in clients with promises of steady, high returns.

But beneath the polished exterior lay a devastating lie.

How the Scheme Worked

A Ponzi scheme operates on a simple but sinister principle: pay early investors with money from new ones, creating an illusion of profit. Madoff’s version was shockingly effective. He lured clients with the promise of consistent, above-market returns, something that should have raised eyebrows. Yet, his reputation and charm kept questions at bay.

Instead of investing the money as promised, he shuffled funds between accounts, fabricating statements to show fake gains. For years, the scheme thrived—until the 2008 financial crisis sent shockwaves through Wall Street.

The Collapse

As markets crashed, panicked investors rushed to withdraw their money. But Madoff’s operation had no real assets—just a house of cards waiting to fall. On December 10, 2008, he confessed to his sons that his entire business was a fraud. The next day, the FBI arrested him.

The fallout was catastrophic.

The Aftermath: Justice and Loss

In 2009, Madoff pleaded guilty to 11 federal felonies, including securities fraud and money laundering. The judge sentenced him to 150 years in prison—a symbolic life sentence for a then-71-year-old man.

The financial toll? A staggering $65 billion in losses.

Who Were the Victims?

- Individuals who lost life savings, retirement funds, and college funds.

- Charities forced to shut down, including foundations backed by Holocaust survivor Elie Wiesel.

- Celebrities and wealthy investors, some of whom unknowingly profited before the scheme collapsed.

Lessons from the Scandal

Madoff’s fraud exposed deep flaws in the financial system:

✔ Trust, but verify – Never invest based solely on reputation. Always demand transparency.

✔ Regulators failed – The SEC received multiple warnings but didn’t act decisively.

✔ Diversify investments – Putting all your money in one place is a recipe for disaster.

Madoff’s Death and Lasting Legacy

Bernie Madoff died in prison on April 14, 2021, but his name lives on as a cautionary tale. His crimes reshaped financial regulations and investor skepticism—reminding us that if something seems too good to be true, it probably is.

Final Thoughts

The Madoff scandal wasn’t just about one man’s greed; it revealed how easily trust can be exploited. While reforms have since tightened oversight, the story remains a stark warning: always question, always verify, and never assume safety in high returns.